What to know about contracting with a Pharmacy Benefit Manager

Jump to:

- What is a PBM and what are their roles and responsibilities?

- What are the Types of PBM Contracts?

- The Contract

- PBM Contract Lifecycle

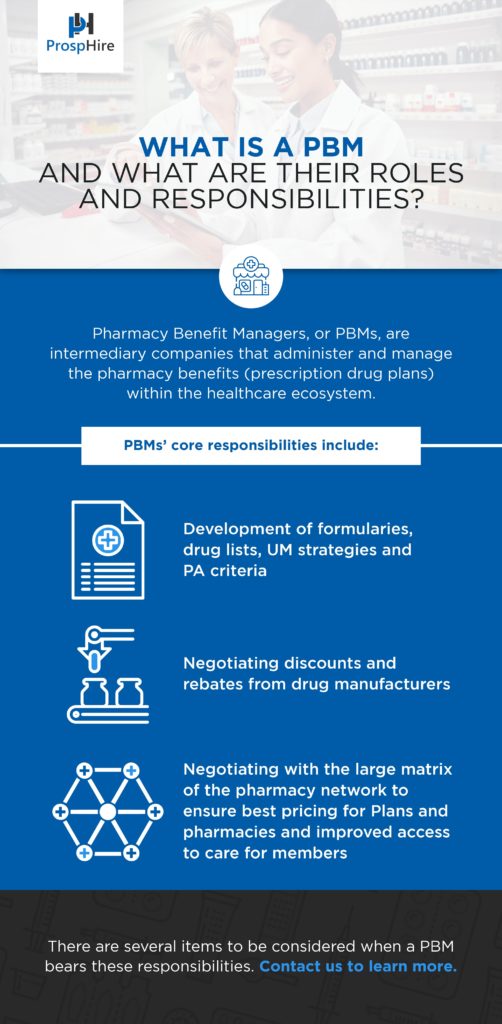

What is a PBM and what are their roles and responsibilities?

Pharmacy Benefit Managers, or PBMs, are intermediary companies that administer and manage the pharmacy benefits (prescription drug plans) within the healthcare ecosystem. Pharmacy Benefit Managers work on behalf of Payors such as Medicare Part D Plans, Employer Sponsored Plans, Managed Medicaid Plans and Health Plans.

Without stringent oversight, pharmacy spend can rise uncontrollably, which is why PBMs have become a necessary stakeholder in healthcare. Operating behind the scenes, PBMs are tasked with controlling prescription drugs costs, which they can accomplish in a variety of ways.

In managing the pharmacy benefit plan, PBMs’ core responsibilities include:

- Development of formularies, drug lists, utilization management (UM) strategies and prior authorization (PA) criteria – all of which have influence in determining members out-of-pocket costs

- Negotiating discounts and rebates from drug manufacturers

- Negotiating with the large matrix of the pharmacy network to ensure best pricing for Plans and pharmacies and improved access to care for members

These require coordination across many stakeholders and are often complex in nature.

There are several items to be considered when a PBM bears these responsibilities.

What are the Types of PBM Contracts?

The marketplace has shifted dramatically in the past few years as more health insurers and health plans move their attention to challenging status quo and seek greater accountability, more transparency and superior performance from their PBM. It’s important to note that a one-size-fits-all approach is typically not in the best interest of the clients. Each plan has varying mix of demographics and aging populations, as well as risk-tolerance.

The types of contracts include:

- Traditional PBM Contracts

Most agreements existing today fall under this bucket and often require the most oversight for measuring contract adherence due to the lack of transparency. Traditional PBM contracts focus on delivering higher rebates to drive “cost savings”. Additionally, under this model, administrative fees are not collected from the client by the PBM. However, masked under the terms of the contract is something called “spread pricing”, which is a large revenue driver for PBMs. Spread pricing can be defined as the difference between what the PBM reimburses the pharmacy that provided the drug to a given member versus the amount a PBM charges the client for that same transaction. Noteworthy is the potential conflicts of interests under this type of arrangement.

- Pass-through Contracts

In a pass-through contract, the PBM transitions to a fully transparent model that may benefit the client via the (full) pass-through rebates and other cost savings. Pass-through PBMs thrive on showcasing their transparent nature; therefore, any or all fees or charges are typically disclosed up front. Under a pass-through arrangement, one may experience a greater depth of customization for utilization management strategies and formulary control.

- Hybrid Contracts

A hybrid contract offers a blend of pass-through and traditional modeling. PBMs may still earn revenue through spread pricing and charge fees; however, they disclose these practices in a more visible manner. That stated, clients are better positioned for receiving a portion of the revenues generated from, for example, rebates passed on from the manufacturer to the PBM. It’s worth noting that incentives may remain somewhat misaligned under a hybrid model by not offering full transparency into true cost-savings potential.

The Contract

PBM contracts can quickly become overwhelming and managing them carefully is no small task. It’s critical to the Plan’s performance to ensure the contract is explicit and does not include potentially damaging loopholes. Understanding the entire agreement is essential for the Plan’s protection. Often these contracts contain lengthy sections filled with nuances that dictate the type of arrangement the Plan and PBM are entering. Definitions are one key section that requires complete understanding and agreement. Sometimes vague, the definitions enable many levers that can result in unnecessary spend. It is essential to ensure definitions align in the Plan’s favor and are best described to protect the Plan.

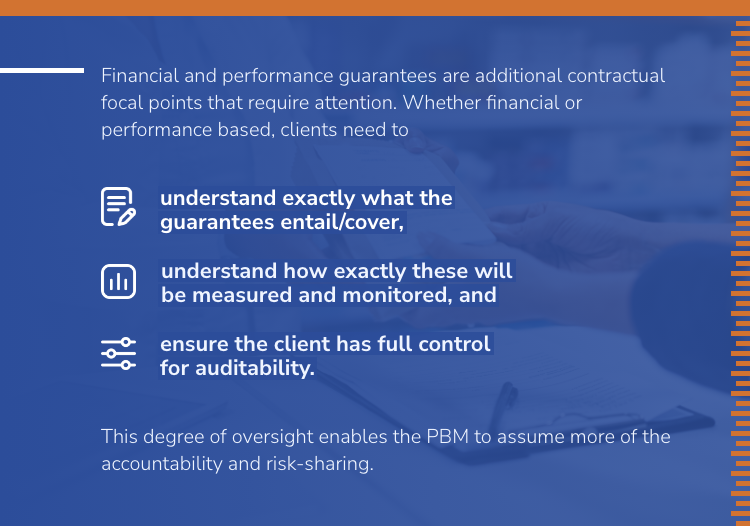

Financial and performance guarantees are additional contractual focal points that require attention. Whether financial or performance based, clients need to A) understand exactly what the guarantees entail/cover, B) understand how exactly these will be measured and monitored and C) ensure the client has full control for auditability. This degree of oversight enables the PBM to assume more of the accountability and risk-sharing.

PBM Contract Lifecycle

The healthcare industry is rapidly changing and much of this is driven by the pharmaceutical industry. As such, it’s imperative for Plan Sponsors to approach their PBM contract with the fluid nature of the industry in mind. Lengthy contract terms may limit the ability for Plans to renegotiate when changes in the market occur.

The PBM contract contains procurement or monitoring. Ideally, the contract also contains flexibility for optimization as the industry evolves over time.

- Procurement can be very involved and is typically a lengthy process. Plan Sponsors in the Medicare or Medicaid space have significantly more considerations to evaluate in the RFP process as compared to Commercial or Employer sponsored plans – compliance and reporting to name a few. However, the complexity and details of the process should not overshadow the need for flexible contract provisions that allow both monitoring and optimization. This requires the inclusion of certain language, as well as the elimination of loopholes that protect PBM interests.

- Monitoring of plan performance could arguably be as important as the negotiated terms. Just because a PBM agreed to certain terms does not mean that they will deliver in their performance. It is incumbent on the Plan Sponsor to hold their vendor accountable to the agreed upon terms and rates. Success here is entirely dependent upon access to timely information and once that data is obtained – having systems to review performance. As claim volumes increase so does the possibility (and likelihood) of errors in processing and payments. It may seem obvious but Plans should never assume that claims are processing as planned.

- Optimization should not occur strictly at contract renewal. There is simply too much innovation in the marketplace to not take advantage of it in “real time”. With an understanding that significant changes cannot occur in the middle of a plan year, Plan Sponsors should not be limited to grow and evolve with the market around them.

Whether you are still within the walls of your current agreement or are in the marketplace for a new PBM, it’s important to understand the lifecycle of PBM contracting. Understanding that procurement of the contract is the just a starting point and not the finish line empowers the Plan to deliver better results to all stakeholders.

How Can ProspHire Help?

The complexity involved when evaluating an agreement with a Pharmacy Benefit Manager is no small task and there are many nuances that dictate real-life outcomes. One bulletproof method to improving value within your Pharmacy Benefits plan is understanding the strategies available, along with having a playbook to deploy during the different phases of the contract lifecycle.

ProspHire has the expertise to augment and support you to ensure all blind spots are covered when it comes to PBM contracting. Regardless of the stage in the PBM contract lifecycle, we will meet you where you are. Get support by filling out our form below.

Let’s have a conversation

ProspHire

216 Blvd of the Allies, Sixth Floor

Pittsburgh, PA 15222

412.391.1100

[email protected]

Quick Links

© 2024 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy