CY2024 Medicare Advantage Final Rule

Let’s have a conversation

The 2024 Medicare Advantage and Part D Final Rule has been released.

On April 5, 2023, CMS released the highly anticipated final rule. This comes just after CMS released the 2024 Medicare Advantage Capitation Rates, Part C and Part D Payment policies on March 31, 2023.

It is essential that plans begin preparing for these impacts now. It is critical that stakeholders understand these changes to methodology, calculations and measures. Developing strategies for these key changes will enable your program to continue to be forward-thinking and positioned for future success.

ProspHire's team of Medicare experts have reviewed the final rule for insights relevant to our Medicare Advantage and Part D partners. Below, we highlight several key changes detailed in the final rule.

Here's what you need to know about the latest final rule changes from CMS relevant to Medicare Advantage Health Plans.

Summary of Final Changes | Risk Adjustment Impacts

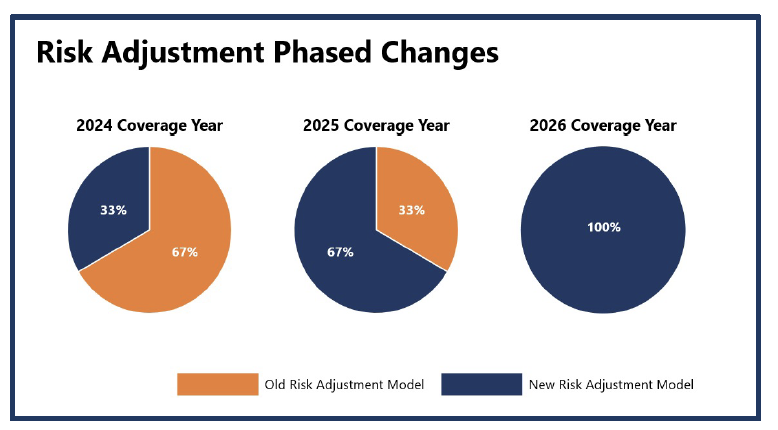

Overview: Within the CMS Final Rate Announcement, CMS has proposed changes to the Part C Risk Adjustment Model to eliminate coding variation and improve payment consistencies to MA plans year over year. Many commenters requested a phased-in approach illustrated on the right, as there will be large process changes and needed education; this approach has been utilized for model updates in previous years.

- Old Risk Adjustment Model: Utilization of the ICD-9 code classification system and related HCC Codes.

- New Risk Adjustment Model: Utilization of the ICD-10 code classification system, clinically revised HCC codes and an increase in the number of HCC codes (86 →115).

Additional Detail of New Risk Adjustment Model:

- The HCC Model was last updated two years ago with FFS claims from program years 2014 and 2015. The revised HCC model will use diagnosis codes from 2018 and expenditures from 2019.

- The new model revises the average per-capita expenditure model to include denominators from 2015 through 2022.

- The updated risk model implements frailty factors to account for the PACE and FIDE SNP populations.

With this adjustment, plans should begin to evaluate their current risk coding processes to ensure the new risk adjustment model is accurately implemented and downstream revenue impacts are minimized. It is imperative that plans begin to:

- Enhance education and tools to support provider partners

- Ensure clear coding specifications and processes are implemented across the organization

- Establish a governance process in 2024 to monitor the implementation of the model and continue to improve processes

Final Rule Changes | Stars Timeline Impact

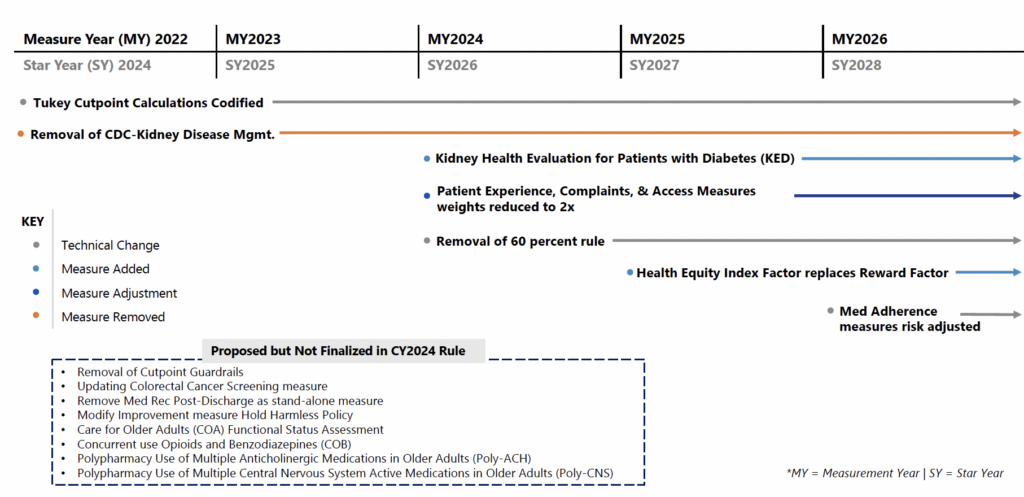

*MA Stars changes will begin in MY2022 (SY2024), with tiered rollout continuing through MY2026 (SY2028).

Final Rule Changes | Stars Measure Weighting Shift

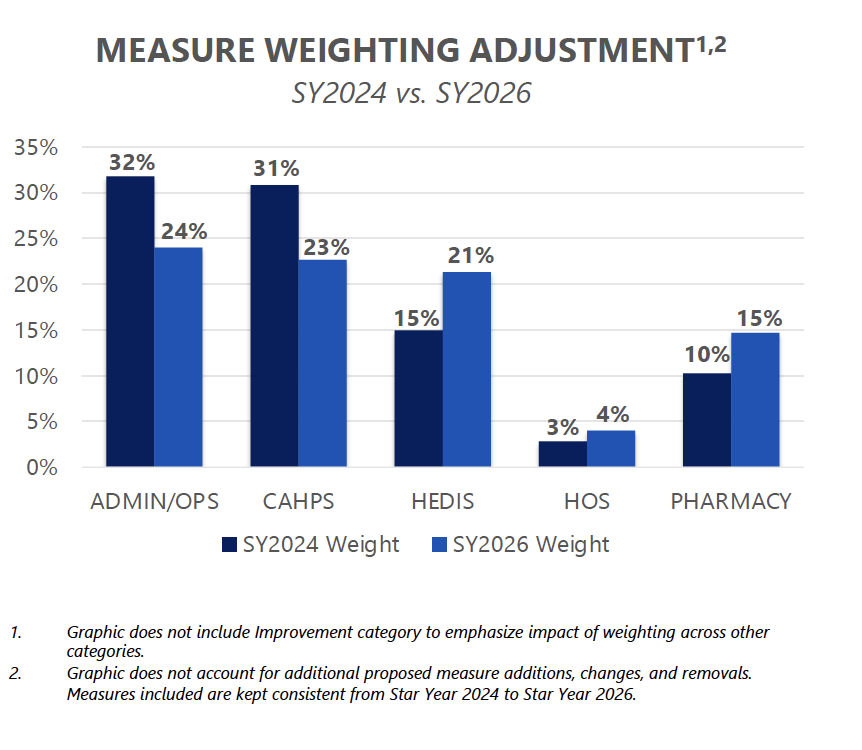

Key Insights: The CMS final rule will reduce the weight of the member experience, complaints, and access measures by half. Previously, these measures were weighted at 4x, but for SY2026 these measures will be weighted as a 2x. Reducing the weighting will better align the patient experience/complaints and access measures more closely with other domains. Plans should continue to focus interventions around listening to the voice of the member given the important link between patient experience, retention, medication adherence and other health outcomes.

Final Rule Changes | Replace Reward Factor with HEI

CMS is proposing to replace the reward factor with a health equity index (HEI) reward for the 2027 Star Ratings to incentivize plans to focus on improving care for enrollees with social risk factors (SRF).

Reward contracts for obtaining high measure-level scores for a subset of enrollees with specified Social Risk Factors (SRFs). The HEI reward is intended to improve health equity by incentivizing MA, cost and PDP contracts to perform well among enrollees with specified SRFs. The HEI is designed to work in conjunction with the current CAI (the measure of a contract's performance relative to its peers) rather than replace it. CMS intends to use the HEI to assist plan sponsors in better identifying and addressing disparities in care provided to members with SRFs. CMS has the ultimate goal of reaching equity in the quality of care provided to enrollees with SRFs. The HEI reward would be calculated using data collected or used for the 2026- and 2027-Star Ratings (2024 and 2025 measurement years) and would initially include LIS/DE or having a disability as the group of SRFs used to calculate the HEI. The regulatory change from CMS involves five proposed steps that CMS would take to analyze the measure-level scores for each contract and roll up to the HEI scores to assess when an adjustment is available for a contract’s ratings.

These steps involve:

- A modeling approach to calculate the scores for the subset of enrollees with SRFs of interest included in the HEI

- Adjusting measures that are case-mix adjusted in the Star Ratings

- Using inclusion criteria for measures to be rolled into the HEI score for a specific contract

- The distribution of contract performance on each eligible measure among enrollees with the specified SRFs would be calculated and separated into thirds to assign a HEI score to a contract.

Stay tuned for more information on the HEI calculation and potential opportunities to collaborate with Social Determinant of Health champions at your health plan.

Summary of Final Changes | Sales and Marketing

The final rule aims to safeguard Medicare beneficiaries from misleading marketing and aims to provide them with accurate and necessary information to make informed decisions about coverage options. To address this, CMS includes the following provisions for Medicare Advantage sales and marketing activities:

- Television advertisements, such as commercials, must identify a plan name stated at the same pace as the contact information.

- Marketing content that causes confusion or misleads beneficiaries is prohibited. This includes the misleading use of the CMS or Medicare names and logos, advertising benefits not available in the beneficiary’s service area and use of superlatives (e.g. “best”) without current source documentation references.

- CMS will hold plans accountable for stricter oversight of agents and brokers by requiring plans to monitor and report non-compliance to CMS.

In addition, the final rule includes guidelines on agent requirements, restrictions and permissible activities. Some changes include:

- Brokers and agents must cover CMS-specified information when meeting with a prospective member and these calls must be recorded.

- Scope of Appointment cards cannot be collected at educational events but Business Reply Cards may be made available to attendees by brokers.

- Agents must identify all Medicare Advantage or Part D organizations they sell on their marketing materials.

- Agents can re-contact beneficiaries to discuss plan options for up to twelve months.

Summary of Final Changes | Behavioral Health

The final rule identifies several behavioral health changes related to network management, access and adequacy, as well as clinical management and coordination, with the stated aim to increase parity between physical and behavioral health services for enrollees in the Medicare Advantage program.

From a network lens, the Final rule initiates the inclusion of Clinical Psychologists and Licensed Clinical Social Workers in network adequacy requirements. CMS also expands the 10-percentage telehealth credit to reach more behavioral health providers by extending eligibility to Clinical Psychologists and Licensed Clinical Social Workers. Further, the final rule requires health plans to notify members when their behavioral health clinician is removed from the plan's network during the plan year. The final rule also includes behavioral health specialties in proposed future standards for appointment wait times.

Additionally, clinical teams can expect changes in behavioral health management and coordination with the CY2024 Final Rule. CMS requires plans to exclude emergency behavioral health services from prior authorization. The Final Rule also expects health plans to instate care coordination programs incorporating behavioral health services.

Overall, health plans should expect an increase in their network management responsibilities to integrate these broader behavioral health requirements. Clinical teams should prepare to meet CMS standards for care coordination services for behavioral health and invest in establishing programs for this population per the Final Rule. Utilization management programs must ensure that their prior authorization policies and systems enable the exclusion of emergency behavioral health services from prior authorization requirements.

ProspHire's Integrated Clinical Solutions experts are prepared to support your health plan in developing clinical transformation plans to prepare for these changes. Our team members are prepared to help your organization with the change management to ensure processes meet CMS guidelines.

Is your health plan ready to react to these changes in CY2024 and beyond?

ProspHire is ready to partner with your health plan to prepare and plan for these changes to the Medicare program.

ProspHire

216 Blvd of the Allies, Sixth Floor

Pittsburgh, PA 15222

412.391.1100

[email protected]

© 2024 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy