Q&A with Andrew Bell: Empowering Health Plans to Excel in Medicare Advantage Performance

Let’s have a conversation

Medicare Advantage (MA) continues to be one of the most competitive and highly regulated sectors in healthcare. With shifting CMS requirements, evolving member expectations and an increased focus on quality outcomes, health plans face growing pressure to balance compliance, cost and performance. ProspHire’s Medicare Advantage Practice helps health plans thrive in this complex environment, bringing hands-on execution experience across Stars performance, risk adjustment, cost savings initiatives, member engagement and operational improvement.

In this Q&A, we sit down with Andrew Bell, Medicare Advantage Practice Leader, to explore the trends shaping MA today, the evolving market and how ProspHire partners with clients to deliver measurable impact.Medicare Stars landscape.

Section 1: Inside the Medicare Advantage Market

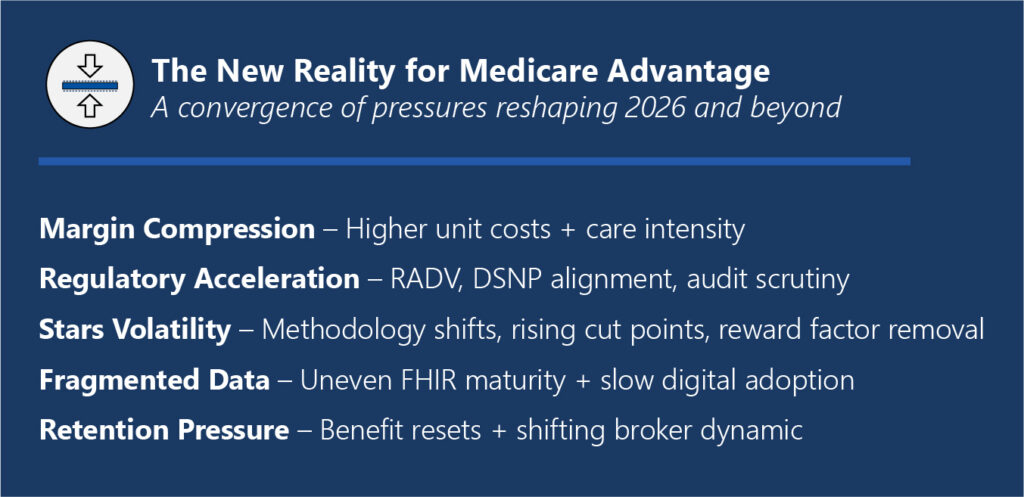

What are some of the biggest challenges facing Medicare Advantage health plans today?

The Medicare Advantage space remains amid massive and fundamental change. Over the past 15 years, the MA industry has experienced nothing but tremendous growth, a favorable regulatory environment, steadily increasing payments and reimbursements and growing membership. As the industry emerges from the unusually favorable conditions of the past few years, plans now face a fundamentally new operating environment. This Medicare Advantage reset is happening at a time when several major pressures are converging.

- Margin compression + utilization volatility: Higher unit costs, post-COVID acuity and site-of-care shifts are outpacing bid assumptions.

- Regulatory whiplash: Rapid measure changes, audit intensity (RADV), supplemental benefit scrutiny and DSNP alignment rules tighten the screws.

- Stars headwinds: Cut points drifting upward, measure redefinitions and reduced cushions (e.g., fewer “easy” lifts), reward factor removal.

- Data fragmentation: Clinical data liquidity is still uneven; FHIR maturity varies by partner; Internal ops aren’t fully digital-first.

- Distribution + retention pressure: Benefit resets strain retention; Broker dynamics and member friction affect mix and persistency.

These market pressures, combined with outdated models for success, will be the reason many Medicare Advantage plans will struggle in the near term.

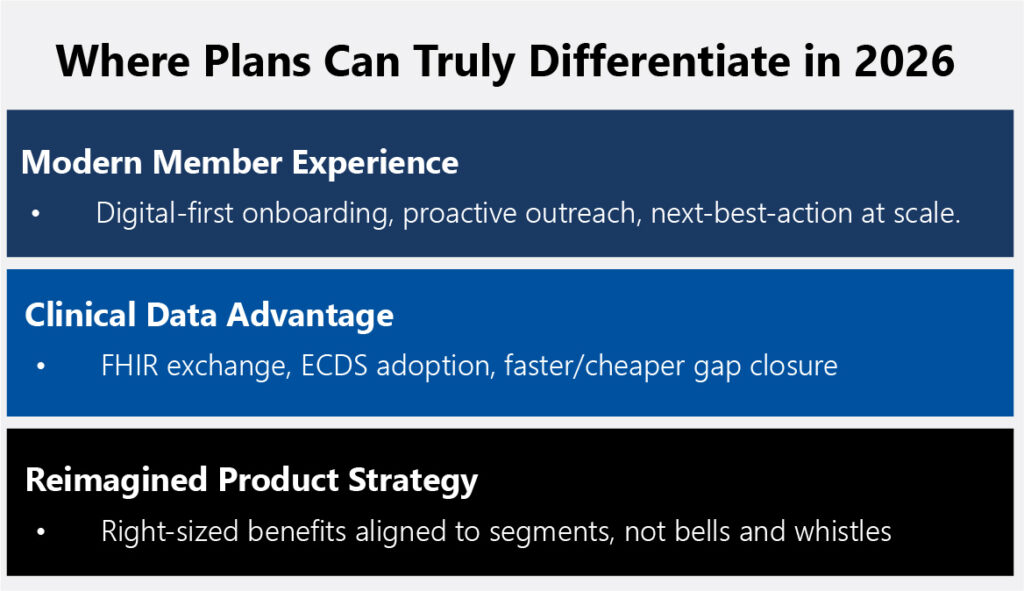

What opportunities exist for plans to differentiate themselves in an increasingly saturated MA market?

In terms of “real” market differentiation, recent years have shown that Medicare Advantage plans have had little “true” differentiation. Plan benefit packages, supplemental benefits and provider networks were nearly identical across markets and carriers. Now, in the age of the Medicare Advantage reset, plans have the tremendous opportunity to truly differentiate themselves not only to members but to providers and regulators.

- Member experience in the modern age: The adage of Medicare Advantage members was that they were primarily baby boomers with little to zero interest in digital engagement and experience. Snail mail, direct to consumer outreach and traditional outreach models worked until they didn't. In fact, this demographic is more tech savvy than ever, not to mention that in five years the first Gen X'er will be Medicare eligible. This means that plans have the true opportunity to treat member experience and engagement like banking and retail and bring it into the modern age, frictionless onboarding, proactive outreach and next-best-action at scale.

- Clinical data advantage: CMS and other regulating agencies continue to push for new and innovative advances in interoperability and digital quality measurement. This top-down approach to innovation can only move as fast as the regulators care to move and the moment is ripe for forward thinking plans to move fast and truly embrace this digital future. Plans should focus on superior ECDS/digital data capture that closes gaps faster (and cheaper) than competitors and FHIR based interoperable data exchanges to further democratize data and place the member at the center.

- Reimagined product strategy: Every plan must do more with less. The age of overly rich benefit packages ripe with all the bells and whistles is gone. Plans need to really consider their market, their specific membership needs and right-size benefits and PBPs around segments (e.g., DSNP, chronic cohorts) rather than trying to be everything to everyone. This reimagined product strategy will certainly be "less rich" than previous benefit cycles but will be a better reflection of the current reality and ultimately will be more sensible and practical as a matter of financial prudence.

Section 2: Driving Stars Performance Excellence

Stars Ratings continue to be a major performance driver for Medicare Advantage organizations. What trends are you seeing across the industry?

It's impossible to separate the larger Medicare Advantage reset from the Stars trends and pressures we're seeing across the industry. In many ways they are inextricably linked. Stars leaders have less discretionary spending at their disposal to throw at late HEDIS blitz's or that intriguing new vendor to pilot. Leaders will have to scrutinize every dollar spent and focus on what truly delivers value and ROI.

Another area of interest is how plans are navigating the rapidly changing Stars regulatory and rule environment. The industry has seen more change in the past two years than we've experienced in the past many years. New measures, new methodologies and new considerations all crashing at the same time is putting pressure to Stars leadership and health plan leadership to maintain the Stars revenue.

Many plans have in the past resorted to large regional or national contracts to concentrate Stars performance on one mega contract. This strategy has yielded great success to those national players by insulating Stars risk and maximizing Stars related revenue. However, the recent Stars regulatory changes are flipping that old model on its head, and many national players are scrambling to understand their exposure (see the most recent Humana Stars loss and the impact to their revenue). I think that this is a big wake up call to health plan leaders who may have taken their prior Stars success for granted. Many plans (even those with consistent 4.0+ success) are taking the time to evaluate their programs and determine whether a new path needs charted, one with less Stars exposure and tighter controls in place.

Last but certainly not least, what remains is the uncertainty on the future of Stars itself. The long-standing program is facing growing criticism from Washington DC policy circles, including groups like the Paragon Institute, as well as from MedPAC, which has repeatedly called for changes to the program and the elimination of quality bonus payments. Wherever the program ends up in the near term, one thing is for sure, changes are coming and plans will be forced to react.

How can plans improve or sustain their Stars Ratings amid regulatory tightening and the new Stars reality?

Plans looking to maintain or grow their Stars Ratings in a period of regulatory tightening and volatile cut points need a dual approach. In the near term, leaders should concentrate on interventions across the sub-set of measures still within reach for the current cycle, focusing on the controllable levers that can meaningfully shift outcomes before submission. Simultaneously, they must begin rebuilding the operating model for the next three years, anticipating the structural realities of future Star Years (SY27–SY29), including digital measure adoption, reward factor removal, the EHO4 all measurement, integration of AI and automation into workflows and finally reduced resources available.

A major driver of Stars success is mastering both the denominator and numerator. Plans must “own the denominator” through eligibility hygiene, attribution accuracy and encounter completeness to minimize avoidable misses and ensure members are correctly represented. Time and time again we see that plans struggle with data capture on the front end, leading to data leakage and numerator devaluing. On the numerator side, success increasingly depends on a reimagination of the vendor stack, standardizing clinical data ingestion, prioritizing FHIR-first architecture, automating evidence capture and compressing cycle times from weeks to days. This operational rigor allows teams to act on near-real-time information rather than retrospective data.

Member experience remains a differentiator. CAHPS performance cannot be treated as a once-a-year campaign. It must be embedded as an operating philosophy that influences every member touchpoint, access, communication and trust. Finally, executive visibility is critical. Weekly Stars reporting at the contract (and potentially PBP) level and the measure level, with a clear path-to-goal and owner accountability, ensures leadership alignment, proactive intervention and real-time decision-making as performance shifts throughout the year.

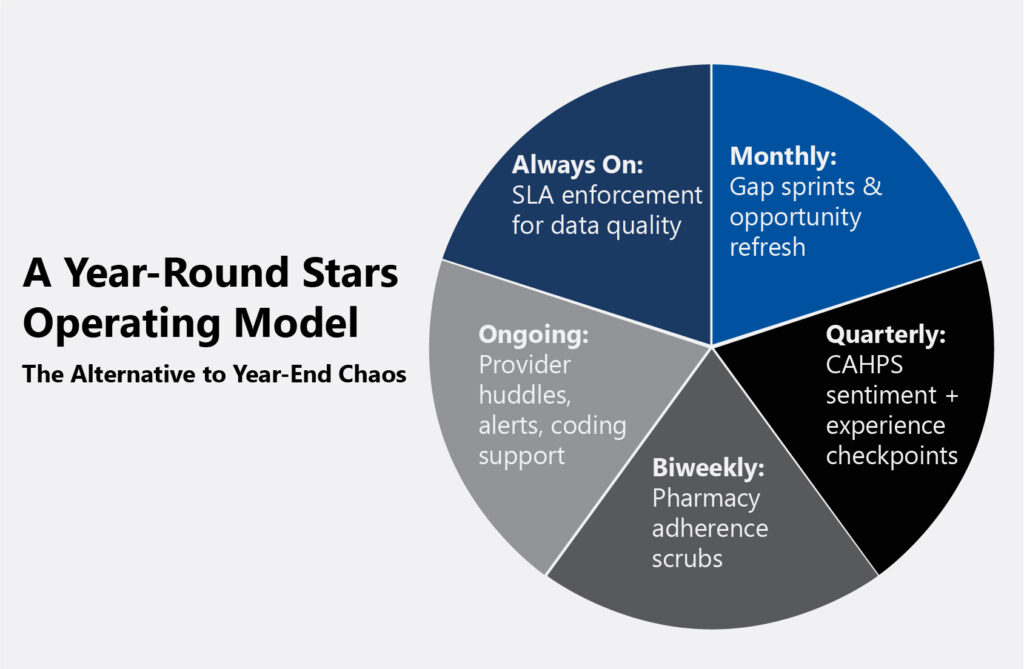

What practical steps can organizations take to enhance performance and avoid the rush of year end?

Sustained performance comes from embedding Stars management into year-round operations rather than relying on end-of-year surge efforts. A 12-month playbook lays the foundation and helps to maintain momentum: monthly gap sprints to close measurable care opportunities, quarterly CAHPS reviews to monitor member sentiment, biweekly pharmacy adherence scrubs to improve medication persistence and ongoing provider performance huddles to reinforce expectations are a few of the many ongoing efforts that need to be deployed.

In addition, provider engagement should be a crucial component of the 12-month playbook. This goes beyond the table stakes of providing visit “starter kits”, coding education, alert systems embedded into care delivery system and performance incentives. With the growing adoption of near-real-time reporting for quality measures through FHIR-CQL adoption, plans and providers can begin to close the gap that exists between them, and start to have more meaningful, real-time discussions of member care.

Data accountability is equally important. Service-level agreements (SLAs) for both internal teams and vendors must define timeliness, completeness, and reconciliation standards to ensure data reliability. Enforcing these SLAs helps minimize lag, rework and reporting discrepancies, allowing quality and Stars teams to make decisions based on accurate, current information rather than chasing data fixes in Q4.

Section 3: Data, Analytics and Member Engagement

How can data and analytics be better leveraged to drive Stars, Risk Adjustment and Quality Performance?

Accurate, complete and streamlined data sets serve as the cornerstone of high-performing Stars, risk adjustment and quality outcomes. This level of data integrity enables plans to pinpoint opportunities, respond quickly to performance gaps and drive meaningful operational improvements. Plans can no longer rely on the status quo, evolving regulatory expectations and digital quality requirements demand a proactive transformation of data strategy and infrastructure. The most effective organizations are reengineering their data foundations to unify clinical and administrative sources into a single analytics pipeline.

A modern approach leverages FHIR-based ingestion, standardized mapping, CQL-driven measure calculation and near-real-time dashboards to transform raw data into actionable intelligence for Stars, risk adjustment and quality programs. By incorporating opportunity scoring, plans can prioritize high-value data source, such as HIEs, EHRs, labs and retail clinics, based on timeliness, yield and cost-per-closed-gap, while closed-loop analytics drive continuous improvement by triggering next-best actions and measuring hit rates, not just identified gaps.

Where do you see the greatest opportunity for innovation in MA, whether through technology, partnerships or process improvement?

The next wave of innovation in Medicare Advantage will be defined by digital quality measurement, interoperability and artificial intelligence, all buoyed against the changing tides of regulatory or agency action. Transitioning from hybrid to fully digital measurement unlocks faster, lower-cost numerator capture and real-time performance visibility, all supported by the growing need for interoperability that enables seamless clinical and administrative data exchange across Medicare. Paired with this, artificial intelligence will also continue to play an emerging role, not as a replacement for human decision-making but as a prioritization engine that predicts which members are most likely to close gaps, which interventions will be most effective and at what cost.

Section 4: Partnering with ProspHire

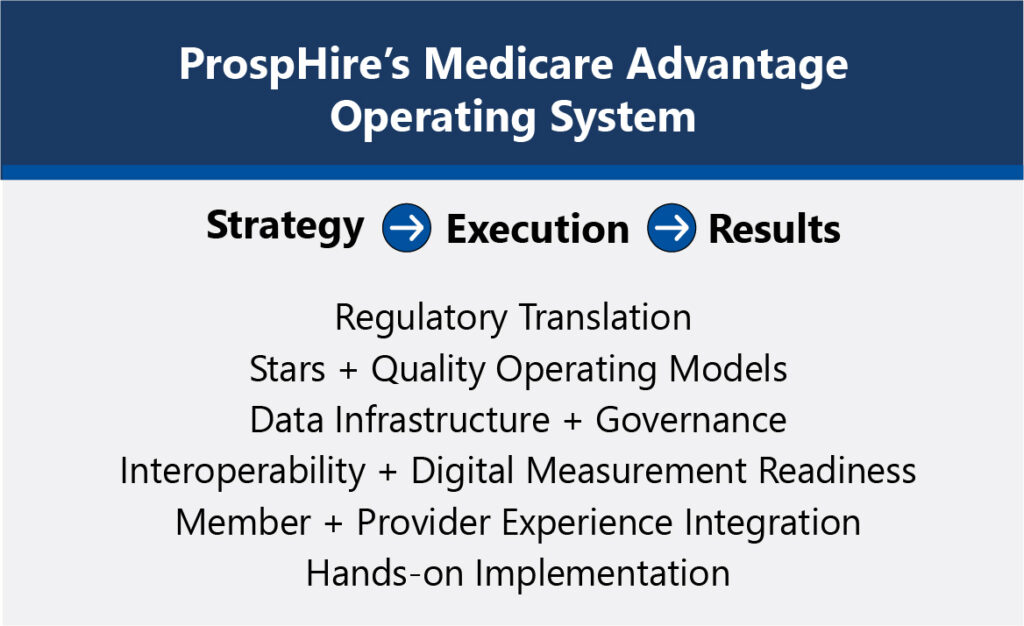

How does ProspHire’s Medicare Advantage Practice uniquely support health plans navigating these challenges?

ProspHire’s Medicare Advantage Practice combines deep regulatory expertise with hands-on implementation capability, enabling plans to translate strategy into sustained performance. Our team bridges the gap between CMS rules and operational reality, turning regulatory language into actionable playbooks, KPIs and accountable workflows. We support clients in building comprehensive Medicare Advantage operating systems that deliver transparency into compliance, benefit administration, care management, member experience and overall operational effectiveness. Our operating systems are complete with clear ownership, measure actions and executive-level dashboards that track progress toward organizational goals.

ProspHire partners with plans to take a forward-looking, proactive stance on regulatory and operational readiness. Unlike traditional advisory firms, we embed alongside client teams to build and stabilize these capabilities, not just design them. ProspHire’s delivery model ensures plans have the data infrastructure, governance and workflows needed to sustain performance year over year.

Looking ahead, what should health plans be prioritizing as they navigate the Medicare Advantage reset?

As the Medicare Advantage market grows increasingly complex, the key to long-term success lies in aligning compliance, quality, total cost of care and operational effectiveness under one strategy. ProspHire brings deep executional expertise, translating strategy into action and driving results that elevate Stars Ratings, member satisfaction and financial outcomes. With a view across data, delivery and engagement, ProspHire helps health plans not only meet CMS standards but set new benchmarks for excellence in Medicare Advantage.

© 2026 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy