Value-Based Care and the Implications of the Expiration of the Public Health Emergency

Let’s have a conversation

Shift to Value-Based Care

Value-based care (VBC) connects financial incentives to patient outcomes associated with care delivery. These include quality, equity and cost of care. Greater accountability is on display as systems, plans and providers are incentivized to improve patient outcomes while ensuring that quality care is provided. Reconciling a transition to value-based care within a fee-for-service environment has proved to be a challenging industry shift for key healthcare stakeholders, a reality that has become increasingly stark since the end of the COVID-19 Public Health Emergency (PHE). Providers must now accommodate to the changes in revenue streams, data collection and analyzation requirements and cost of care inherent to a transition to value-based healthcare systems. Accommodation begins by reassessing current operational strategies. The foundation of reassessment begins with the identification of high-cost drivers which enables a better understanding of target populations and develop targeted interventions and strategies around cost containment, member experience and quality outcomes. To be successful in VBC, effective care continuum partnerships are critical as members navigate through increasing healthcare touchpoints.

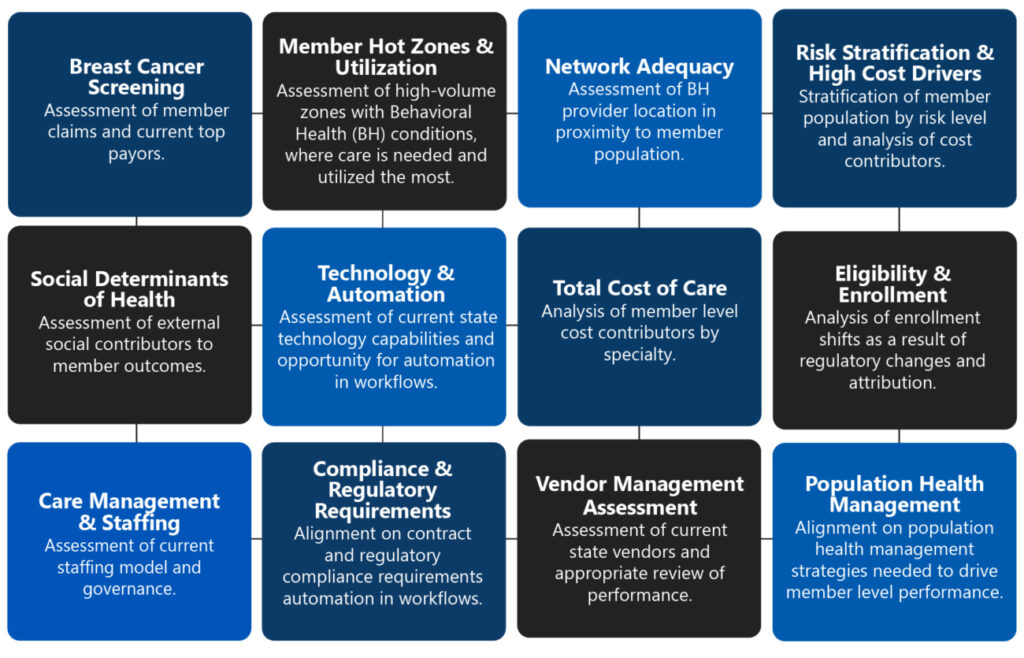

VBC Capabilities Assessment Components

The essentials of a capabilities assessment catered towards value-based care begin with the following components. A thorough understanding of these levers will enable organizations to understand current state capabilities to desired future state advancements.

Public Health Emergency and Behavioral Health

The Public Health Emergency (PHE) was passed to mitigate challenges related to care delivery, financing and acute staffing constraints associated with the global pandemic. The waivers and regulatory flexibilities alleviated healthcare system challenges and accelerated change in a positive manner. Three years later, components of the PHE come to an end with CMS implementing a streamlined approach to reestablish certain health and safety standards and other financial and program requirements related to coverage and screening, claims appeals, provider licensure and enrollment, patient and provider safety, COVID-19 testing protocols, data reporting and telehealth flexibilities. The pandemic further exacerbated the demand for behavioral health services highlighting many of the shortcomings associated with overall behavioral health care. There are significant gaps between behavioral healthcare needs and availability. As the industry continues to see a rise in individuals experiencing behavioral health problems, access to care remains limited, wait times continue to rise, network adequacy, and virtual health. With the PHE’s expiration on May 11, 2023, many questions and concerns arise associated with access, covered services and expenditure specifically as it relates to behavioral health. Organizations may need to make drastic changes as the regulatory enforcement returns to normal and ensure minimal disruption to their billing and operations.

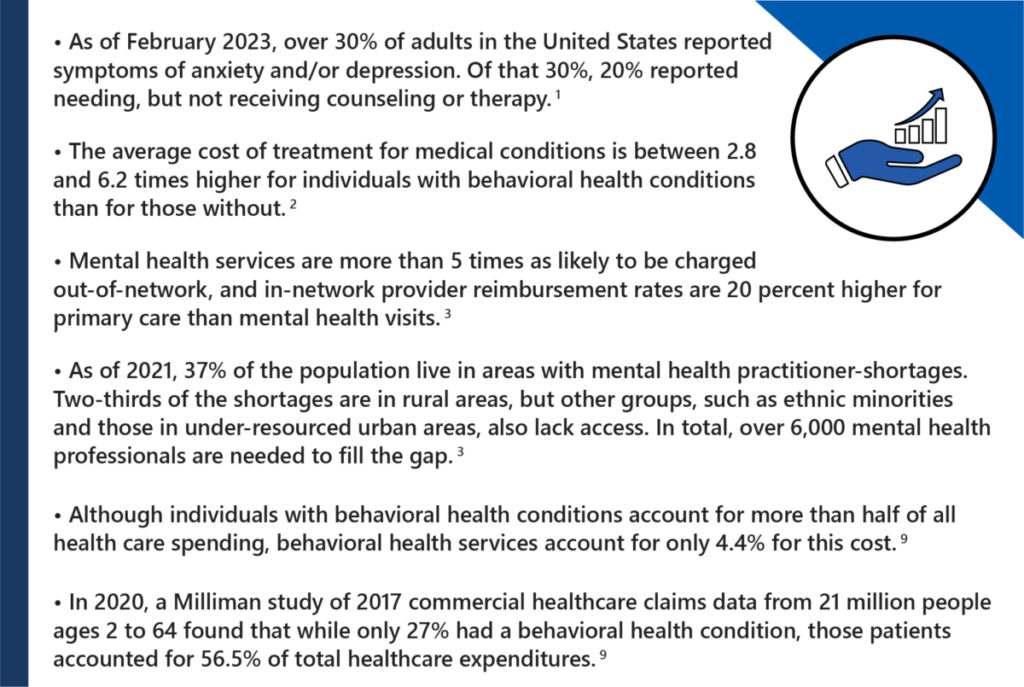

Industry Statistics

Behavioral health will continue to evolve as Value-Based Care matures. It is critical to maintain a thorough understanding of industry shifts and trends to ensure your organization does not fall behind and become exposed to internal and external risks.

Trickle-Down Impact of Public Health Emergency on Behavioral Health

The expiration of the Public Health Emergency (PHE) caused industry leaders to reengage in long-term strategies. In particular, the PHE impacts Behavioral Health in the following manner:

Value-Based Care Outlook

Healthcare providers face a litany of uncertainty. Key stakeholders should remain proactive and understand the changing regulatory landscape on their current operations and develop system-wide strategies to mitigate operational, financial and compliance-related risks to minimize the potential negative downstream impacts on patient outcomes. People with behavioral health conditions are at greater risk of developing chronic diseases such as heart disease or diabetes and are connected to social determinants.

It is imperative stakeholders take a plan of action to align on strategies and make adaptations that will improve member outcomes.

- Assessment of internal processes, technology, resources and operational capabilities to increase behavioral health screening, interventions, medication management and adequate referrals

- Provider shortages, case management and care coordination strategies

- Marketplace enrollment fluctuations

- Optimization of current mental health product offerings, benefits, and cost-sharing strategies

- Education, engagement, and services for family members

- Reimbursement strategies and policy changes providers became accustomed to during the pandemic

Why ProspHire

As we have seen in the Health Care Payment Learning & Action Network (HCPLAN), the evolution of current payment models is on the rise from FFS without a link to quality and value to innovative APMs and population-based payments. ProspHire has the subject matter experts to help clients achieve value-based quality outcomes and savings by participating in various value-based arrangements. We have the right team to deliver a transformative solution that will yield positive results.

References:

- https://www.kff.org/statedata/mental-health-and-substance-use-state-fact-sheets/

- https://www.fiercehealthcare.com/payer/cigna-study-how-much-behavioral-health-treatment-can-lower-total-cost-care

- https://www.whitehouse.gov/cea/written-materials/2022/05/31/reducing-the-economic-burden-of-unmet-mental-health-needs/

- https://www.kff.org/medicaid/issue-brief/10-things-to-know-about-the-unwinding-of-the-medicaid-continuous-enrollment-provision/

- https://www.mgma.com/practice-resources/quality-patient-experience/valuing-access-to-behavioral-healthcare-over-trans

- https://www.modernhealthcare.com/patient-care/behavioral-health-patients-spur-57-commercial-healthcare-spending

- https://www.fiercehealthcare.com/providers/covid-19-public-health-emergency-has-ended-here-are-biggest-changes-you-need-know

- https://www.aha.org/guidesreports/2022-05-31-trendwatch-impacts-covid-19-pandemic-behavioral-health

- https://www.milliman.com/-/media/milliman/pdfs/articles/milliman-high-cost-patient-study-2020.ashx

ProspHire

216 Blvd of the Allies, Sixth Floor

Pittsburgh, PA 15222

412.391.1100

[email protected]

Quick Links

© 2024 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy