Contract Year 2027 Medicare Advantage Proposed Rule: The Medicare Advantage Reset is Here and Stakes Couldn’t Be Higher

Let’s have a conversation

On November 25, 2025, CMS released the Contract Year (CY) 2027 Medicare Advantage and Part D Proposed Rule, a 400+ page regulation that reaches into nearly every aspect of MA and Part D operations.

Paired with the RFI on the future of Medicare Advantage, this rule marks a true turning point in the Medicare Advantage program. We’ve been talking a lot recently about the Medicare Advantage Reset and the need for plans to take a hard look at their models for success and now CMS has acted. Through the Proposed Rule, CMS is looking to simplify the program by reducing administrative burdens for marketing oversight, while also setting the stage for bigger shifts in risk adjustment, Stars & quality bonus payments and special needs plans. Plans need to take this moment seriously and recognize we’ve moved beyond business as usual. We’re now in the next era of Medicare Advantage.

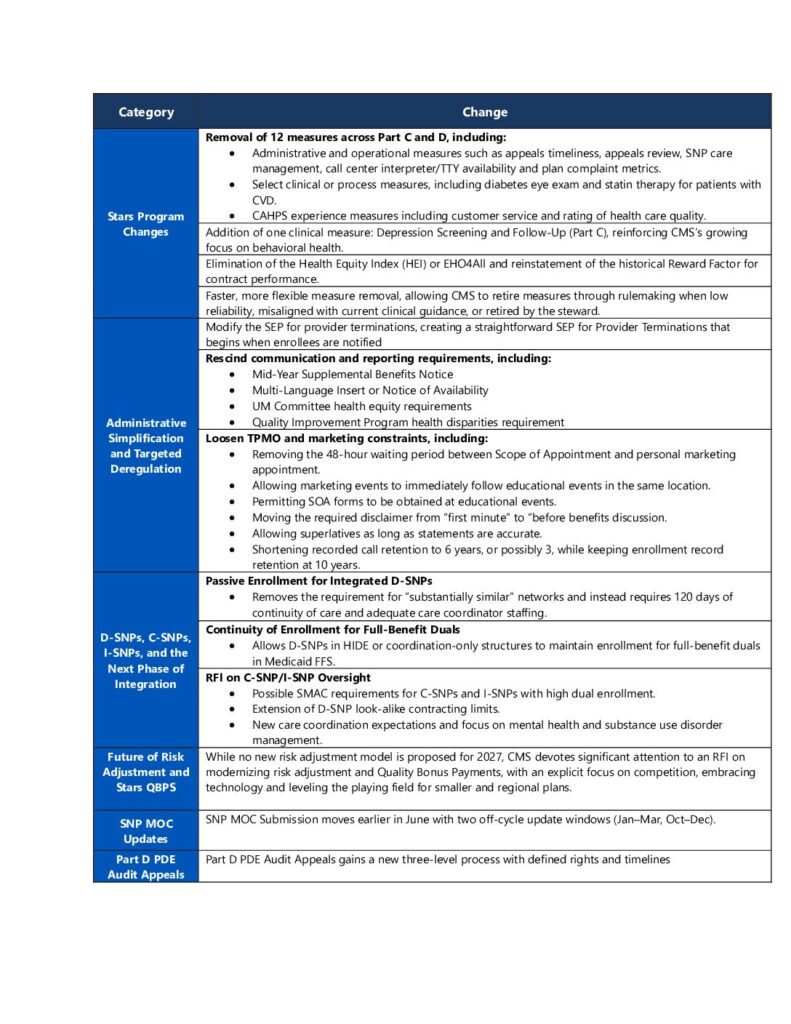

Executive Summary: Four Big Themes for Plans

From a plan and operator perspective, four primary themes stood out to us in this proposed rule and related RFIs:

- A Leaner, Sharper Stars Program

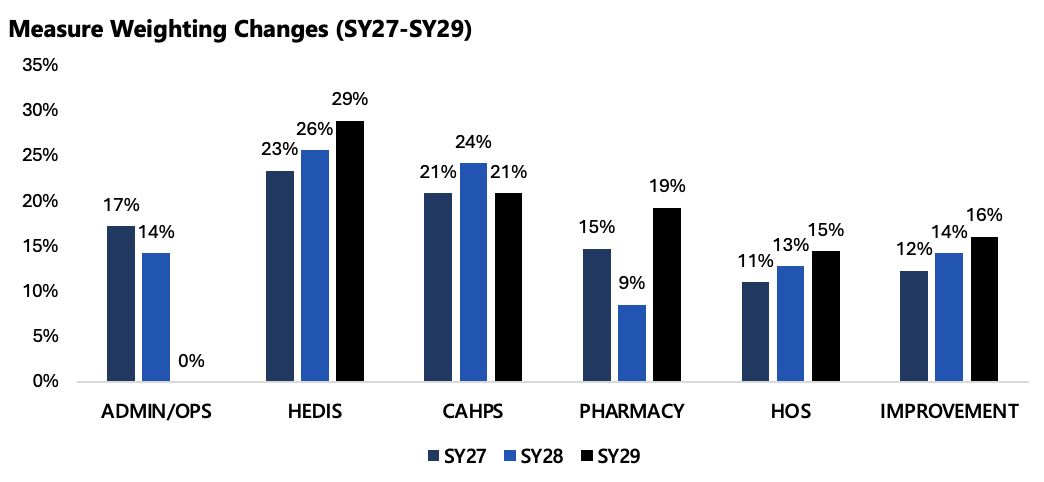

- After much anticipation and industry noise, CMS is finally proposing a shift away from operational obligations and toward measurable member health outcomes, proposing to remove 12 measures, introduce a new depression screening and follow-up measure. This pivot is also in line with the “MAHA” agenda from this administration.

- CMs has also proposed not move forward with replacing the Health Equity Index (HEI) with the historical Reward Factor.

- Given these changes, CMS simulations suggest 62% of contracts would see no Stars change, around 13% gain a half star, around 25% would lose a half star and one contract losing a full star, with around 9% gaining or losing QBP status.

- CMS is explicitly asking for feedback on further simplifying the measure set and methodology while reorienting toward outcomes, prevention and healthy aging.

- Targeted Deregulation and Reduced Administrative Burden

- CMS proposes to rescind several recent health equity and disparities reporting requirements (UM health equity analysis, QI health disparities activities, public posting) and eliminate the Mid-Year Supplemental Benefits Notice and Multi-Language Insert/Notice of Availability.

- Third Party Marketing Organization (TPMO) rules are loosened, with fewer constraints on timing and location of marketing appointments, shorter call recording retention and more flexibility in marketing language, within a “not misleading” standard.

- A Deeper Look at Special Needs Plans

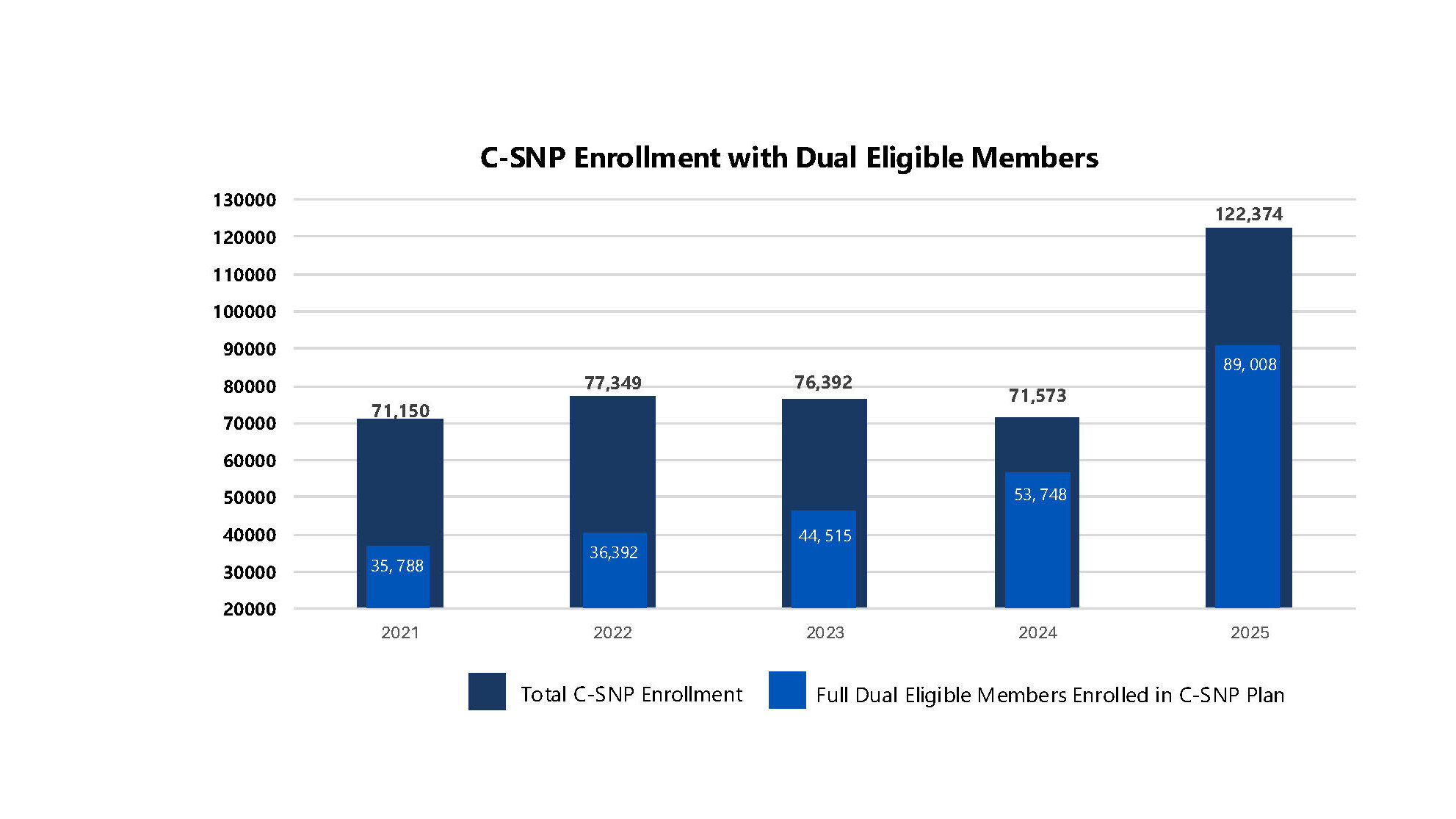

- CMS has observed rapid growth in C-SNP and I-SNP enrollment, raising concerns that many of these members may be better served in a D-SNP, where their Medicare and Medicaid benefits can be fully integrated, something C-SNPs and I-SNPs do not provide.

- The rule and RFI explore stronger state oversight of C-SNPs/I-SNPs (via SMAC-like requirements), extension of D-SNP “look-alike” policies and enhanced expectations for care coordination and integration.

- Future of Risk Adjustment and Stars QBP: CMS Wants Ideas

- While no new risk adjustment model is proposed for 2027, CMS devotes significant attention to an RFI on modernizing risk adjustment and Quality Bonus Payments, with an explicit focus on competition, embracing technology and leveling the playing field for smaller and regional plans.

- CMS also proposes to broaden access to risk adjustment data for research and oversight, reflecting a growing emphasis on transparency, program integrity and long-term sustainability of MA.

- CMS is seeking information on how artificial intelligence can be leveraged alongside current or future risk adjustment methodologies.

The Net Message: CMS is willing to pull back on some administrative and reporting requirements but only if the industry steps up with credible, data-driven proposals to advance quality, integration, transparency and member value. This program isn’t going anywhere but changes are needed to ensure its long-term viability and longevity.

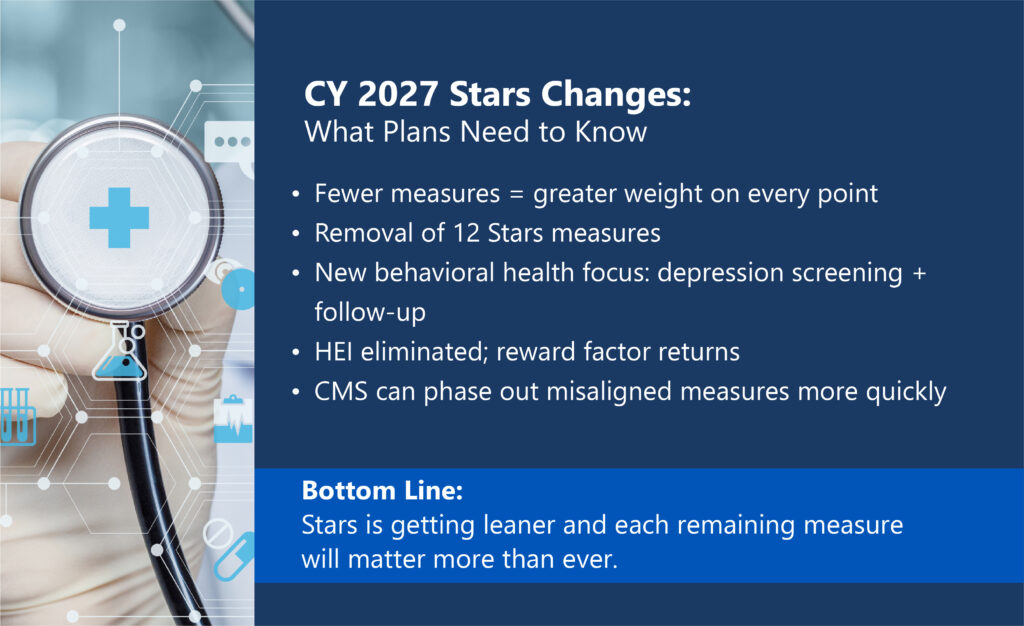

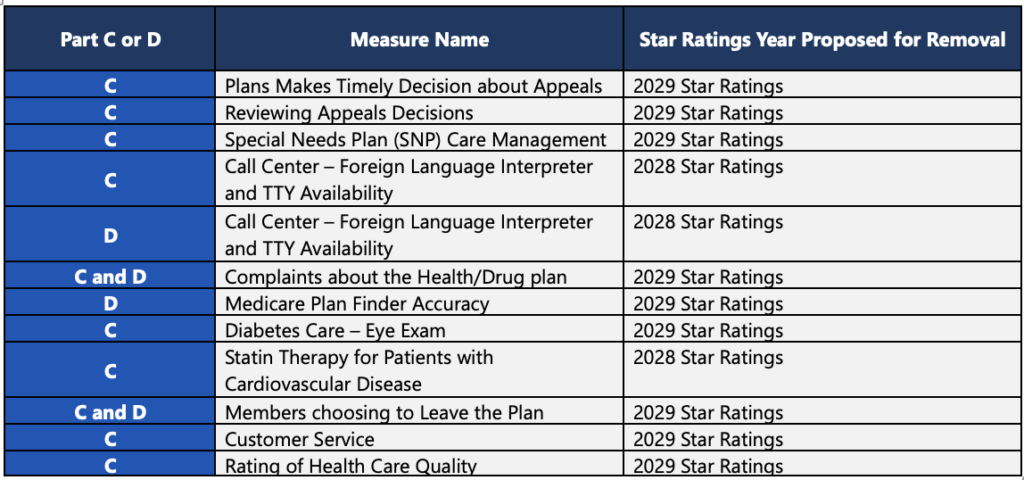

Stars Ratings: A Smaller Set with Bigger Consequences: What CMS is Proposing?

Key changes to the Stars program in the CY 2027 proposed rule include:

- Removal of 12 measures across Part C and D, including:

- Administrative and operational measures such as appeals timeliness, appeals review, SNP care management, call center interpreter/TTY availability and plan complaint metrics.

- Select clinical or process measures, including diabetes eye exam and statin therapy for patients with CVD.

- CAHPS experience measures including customer service and rating of health care quality.

- Addition of one clinical measure: Depression Screening and Follow-Up (Part C), reinforcing CMS’s growing focus on behavioral health.

- Elimination of the Health Equity Index (HEI) or EHO4All and reinstatement of the historical Reward Factor for contract performance.

- Faster, more flexible measure removal, allowing CMS to retire measures through rulemaking when low reliability, misaligned with current clinical guidance, or retired by the steward.

CMS’s impact simulations indicate:

- Around 62% of contracts see no change in overall Star Rating

- Around 13% gain 0.5 star

- Around 25% lose 0.5 star

- 1 contract loses 1.0 star

- Around 9% of contracts gain or lose QBP status

What It Signals

The Stars Program is not being gutted (for now). CMS even acknowledges that the technical expert panel recommended more measures, to dilute a plans ability to only focus on a handful of “critical ones”. In our opinion, CMS could be gearing up for a new plethora of outcomes based and health/behavior health measures soon. Especially in this new “MAHA” world, CMS is reinforcing clinical outcomes, preventive care and member experience as the core levers of Stars. Results based and data driven is the name of the game here. Look to measure stewards for changes to measures and new possibilities.

Implications for Plans

Every plan needs to immediately refresh and re-run Stars models with the proposed changes, including new/removed measure changes and weighting implications. A fulsome examination of vendor partnerships, strategic priorities, technology stack and intervention plan needs complete, to ensure alignment toward CMS’s signaling changes. This includes a rebalance of interventions toward high-impact clinical measures such as chronic condition management and behavioral health. Lastly, decisions are made by those who show up…engage in the RFI process, offering data on outcomes and operational feasibility.

Administrative Simplification and Targeted Deregulation

A second through-line in the proposed rule is deregulation, removing certain requirements that have grown up around MA plans in recent years.

Key Proposals

CMS Proposes To:

- Modify the SEP for provider terminations, creating a straightforward SEP for Provider Terminations that begins when enrollees are notified.

- Rescind communication and reporting requirements, including:

- Mid-Year Supplemental Benefits Notice

- Multi-Language Insert or Notice of Availability

- UM Committee health equity requirements

- Quality Improvement Program health disparities requirement

- Loosen TPMO and marketing constraints, including:

- Removing the 48-hour waiting period between Scope of Appointment and personal marketing appointment.

- Allowing marketing events to immediately follow educational events in the same location.

- Permitting SOA forms to be obtained at educational events.

- Moving the required disclaimer from “first minute” to “before benefits discussion.

- Allowing superlatives as long as statements are accurate.

- Shortening recorded call retention to 6 years, or possibly 3, while keeping enrollment record retention at 10 years.

Implications for Plans. Recalibrate, don’t over-relax. Even with looser marketing timing and language rules, strong internal monitoring and oversight remain essential to ensure guardrails are clear and consistently followed. Reinvest freed resources from reduced administrative tasks into more high value areas.

D-SNPs, C-SNPs, I-SNPs, and the Next Phase of Integration

The industry has experienced an explosion of growth in C-SNP and I-SNP enrollment and CMS has noticed. In this rule, CMS provided evidence that many of these members that are dual eligible and may be better served in a D-SNP, where their Medicare and Medicaid benefits can be fully integrated, something C-SNPs and I-SNPs do not provide.

Key Provisions and Ideas

- Passive Enrollment for Integrated D-SNPs

- Removes the requirement for “substantially similar” networks and instead requires 120 days of continuity of care and adequate care coordinator staffing.

- Continuity of Enrollment for Full-Benefit Duals

- Allows D-SNPs in HIDE or coordination-only structures to maintain enrollment for full-benefit duals in Medicaid FFS.

- RFI on C-SNP/I-SNP Oversight

- Possible SMAC requirements for C-SNPs and I-SNPs with high dual enrollment.

- Extension of D-SNP look-alike contracting limits.

- New care coordination expectations and focus on mental health and substance use disorder management.

Implications for Plans. CMS expects more integration between Medicare and Medicaid, not segmentation. The more closely aligned these programs are, ultimately provides a better experience for the member. Plans should reevaluate duals portfolio strategy and model the financial and operational impact of SMAC or look-alike rules. They should also continue to strengthen state partnerships and care coordination infrastructure and embrace AI/automation technology. Lastly, plan leaders should prepare for a regulatory environment that favors integrated D-SNP over C-SNPs and I-SNPs.

Future of Risk Adjustment and Stars QBP

Although CMS did not meaningfully commit to or propose sweeping change to Risk Adjustment or Quality Bonus Payments, CMS did ask, “what should the next generation of MA payment, risk adjustment and quality policy look like?”. CMS continues to express a willingness and frankly an eagerness to hear from the industry. CMS is seeking to enhance competition and level the field for smaller and regional plans, something that has been needed for some time now. They also are seeking perspectives on how artificial intelligence can be leveraged and how to improve accuracy and integrity of risk adjustment including expanding access to risk adjustment data for research and oversight. Although not reflected in this proposed rule, make no mistake, big changes are coming for Risk Adjustment either in a future proposed rule or through a mandatory Innovation Model.

Implications for Plans. Plans should be responding to CMS’s RFI and provide data-driven comments that balance fairness, accuracy and predictability in the Risk Adjustment program. Any small or regional plan should highlight regional plan challenges and propose practical remedies. Lastly, plans should seek to link innovation and data to measurable member outcomes.

Other Notable Proposals

- SNP MOC Submission moves earlier in June with two off-cycle update windows (Jan–Mar, Oct–Dec).

- Part D PDE Audit Appeals gains a new three-level process with defined rights and timelines.

Strategic Roadmap for Plans

Leading organizations should act now on three fronts:

- Policy and Advocacy: Create a coordinated review strategy for this proposal to ensure thorough, well-supported and meaningful comments are provided back to CMS. Respond to RFIs related to Stars measure set, duals policy, risk adjustment modernization and TPMO rules.

- Analytics and Scenario Modeling: Re-forecast Stars and QBP outcomes. Map dual populations across product types and simulate regulatory changes. Quantify administrative burden reductions and plan reinvestment opportunities.

- Operating Model and Governance: Refresh Stars and Quality governance to reflect outcome-focused measures. Update marketing and compliance policies for new TPMO rules. Strengthen duals integration, care coordination and continuity processes.

Closing Thought:

The reality is that the 2027 Proposed Rule for Medicare Advantage, is not simply a minor adjustment or a small tweak to a legacy program, it is the opening move in a broader Medicare Advantage reset. The convergence of new technology, a changing regulatory environment and an intensely dynamic marketplace is making it impossible to succeed using yesterday’s playbook. Product strategy, benefit design, network and care models, Stars and quality, risk adjustment, duals integration, sales and marketing, data and technology, all of it is in scope. Old models of success need to be challenged and future models of success need to be invented and operationalized now.

This is the first Medicare Advantage proposal of the new administration and it is a clear signal that more structural change is coming. Stars changes are here, and more are inevitably on the horizon. Risk adjustment will be changed, the only question is when and how, not if. Through the RFIs in this rule and related Innovation Center work, CMS is explicitly asking the industry to help design the next era of Medicare Advantage. Decisions are made by those who show up and plans that engage thoughtfully, offer data driven perspectives and put forward practical ideas will be better positioned for whatever comes next. ProspHire is here to help you navigate the flurry of change and take a thoughtful, methodical approach to this new reality. We partner with health plans to reassess and modernize Medicare Advantage operating models, from Stars and risk adjustment to product and network strategy, duals and SNP portfolios, data and analytics and sales and marketing governance. We can help you game plan scenarios, quantify impact, redesign processes and craft clear, compelling responses to RFIs and proposed rules. The Medicare Advantage reset is underway. The organizations that thrive will be those willing to throw out outdated assumptions and start designing their next model of success today.

© 2026 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy