Does Your Plan’s Performance Align with Your Pharmacy Strategy?

Does Your Plan’s Performance Align with Your Pharmacy Strategy?

Talk to a Healthcare Professional

The Centers for Medicare and Medicaid Services (CMS) National Health Expenditure (NHE) data

highlights the excellent healthcare spending growth year over year. Up nearly 10% from 2019, the U.S.

spent $4.1 T on healthcare costs in 2020, and prescription drugs accounted for 8% of the total spend

(roughly $348B).

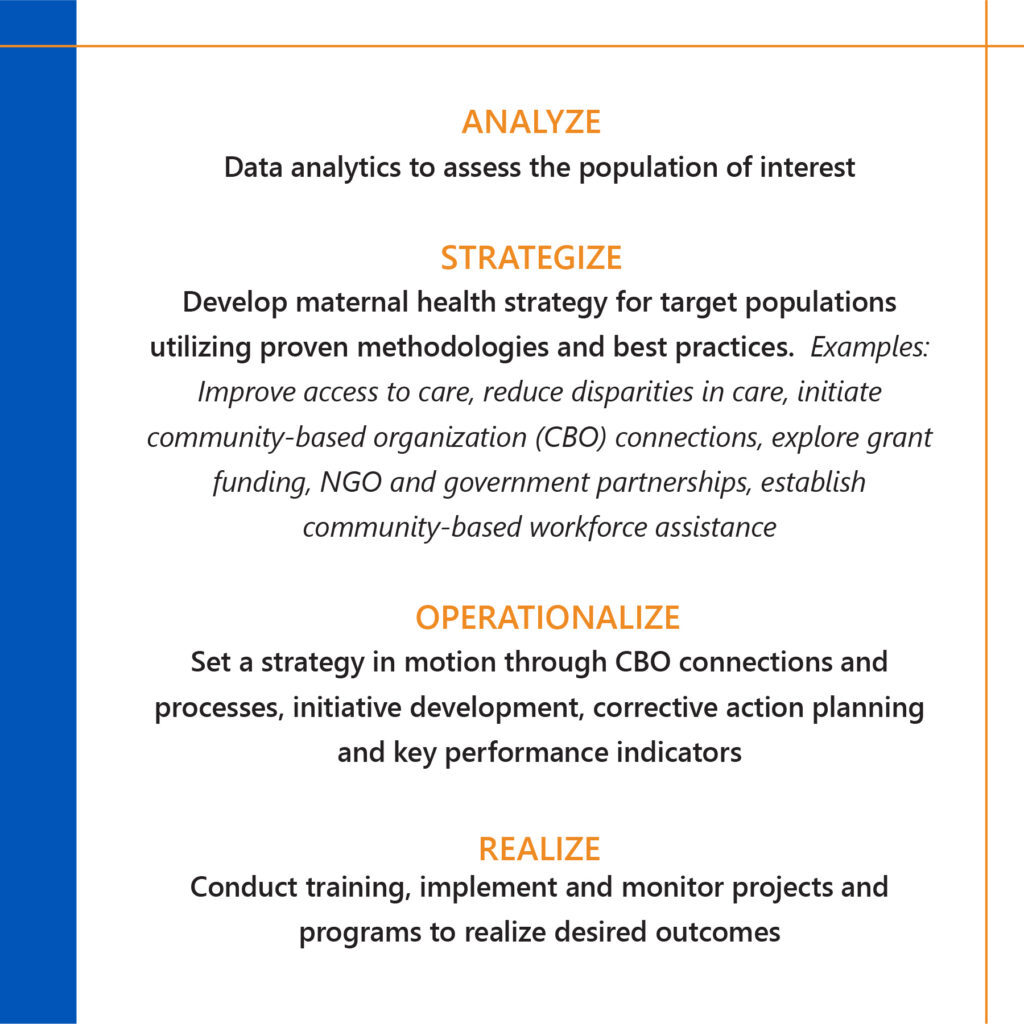

As stricter regulations, innovations and other drivers rise, plan sponsors should evaluate their strategy

and key priorities regarding pharmacy benefits and prescription drug costs. The ever-changing pharmacy

landscape supports the importance of a tailored pharmacy strategy.

What does your current pharmacy strategy look like? Is it a robust plan with a clear direction? Are the

appropriate levers in place to meet quality standards and optimize plan performance?

You could be leaving money on the table by not having a defined strategy. This gap opens the door for

poor member experience, unoptimized clinical programs, over-utilization of prescription drugs, and a

lesser quality of care. It ultimately impacts the financial and operational performance of your plan’s

pharmacy offering.

Below we explore pharmacy strategy considerations in three areas, along with how market trends are

driving many plans to reconsider their strategic priorities.

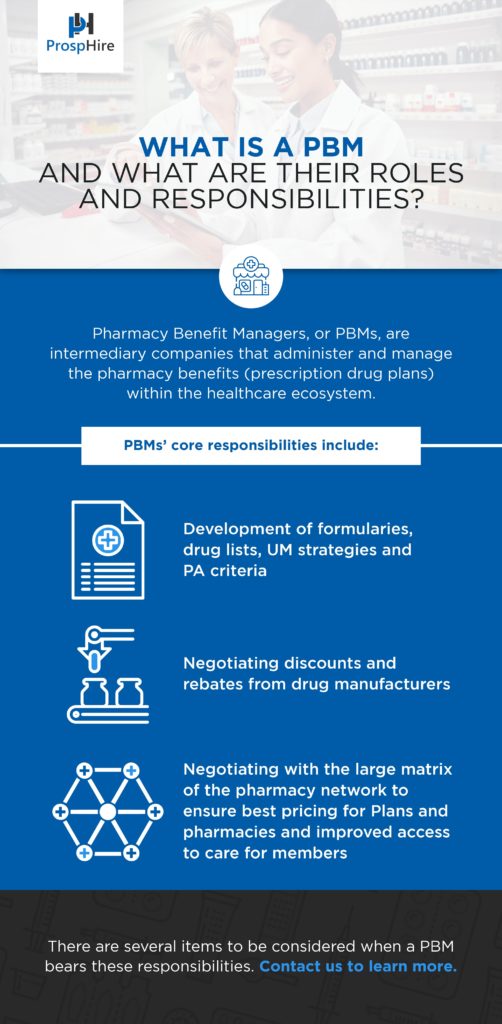

Pharmacy Benefit Management (PBM):

The Pharmacy Benefit marketplace continues to evolve through plan benefit design, innovative pricing

strategies and more educated purchasers of PBM services. Many plan sponsors are reevaluating their

approach and priorities for managing prescription drug spending. The renewed priorities are improved

cost containment strategies and pricing transparency. Recent findings from audits of pharmacy benefit

pricing practices in several state Medicaid programs have uncovered considerable opportunities for cost

savings to the plans. These findings have created an opportunity for plan sponsors to evaluate the

appropriateness of their potential pricing efficiencies and PBM contract performance.

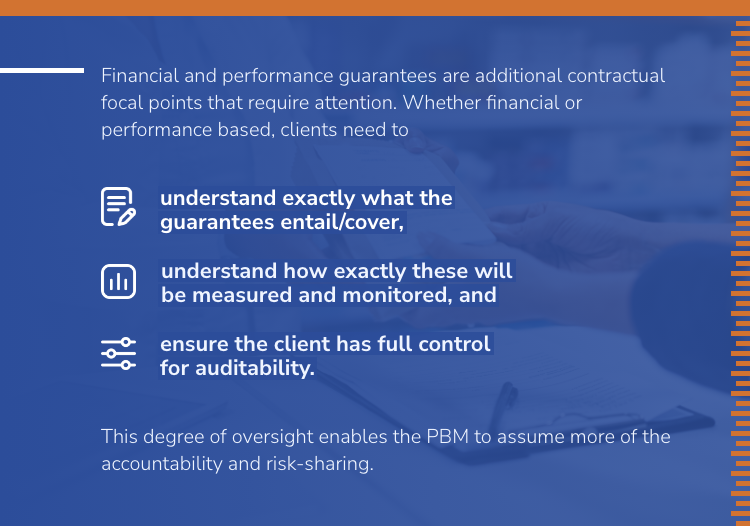

Many traditional PBM contracts are written with somewhat vague and complex language, creating

ambiguity. By framing your pharmacy benefit strategy through transparency and accountability, your

plan becomes better positioned to work with a PBM that shares aligned incentives. Performing a

contract review and assessing how your PBM contract is performing against adjudicated claims serves as

a practical exercise for identifying pricing inefficiencies and determining your future strategy.

Specialty Pharmacy Optimization:

Prescription drug costs continue to be a concern for plan sponsors. The past ten years have brought revolutionary, life-sustaining and life-changing treatments to market; however, it has brought higher price tags.

Moving forward, plan sponsors seek innovative approaches and solutions to review the costs associated with these specialty therapies. One key strategy for approaching specialty treatment costs is value- based arrangements. This has been somewhat controversial over the past few years but remains a hot topic and key priority for many plans. Getting the best price on the wrong drug is a bad deal for everyone. Therefore, plans must gain the ability to measure the effectiveness of these treatments and member outcomes.

One market trend to watch in 2023 is biosimilars. Biosimilars have the opportunity to be the gateway to value-based outcomes. Though biosimilars exist today, several are scheduled to come to market and contest the world’s top-selling prescribed therapy, Humira, in 2023. To date, we’ve seen mixed reactions on biosimilars' uptake or interchangeability, but Humira's biosimilars can change this narrative and create enhanced price modeling for future therapies.

In the meantime, plan sponsors are evaluating their current specialty strategy. One example is assessing benefit designation for high-cost specialty treatments. A plan can identify potential cost-saving opportunities by comparing reimbursement determination with differing benefits. Typically, this approach is deployed for high-cost therapies being managed under the medical benefit and assessing the clinical and economic value of transitioning them to the pharmacy benefit.

Medicare Part D Enhancement:

Medicare Part D spending has grown faster than the rest of Medicare due in part to increasing prescription drug prices. Estimates show that approximately $111B will be spent by the program to provide coverage for more than 2 billion prescriptions in 2022.

Amending the design of the Medicare Part D benefit, the Inflation Reduction Act of 2022 (IRA) Prescription Drug Provisions are being considered a milestone achievement for lowering prescription drug costs. Several vital provisions were included in this act to reduce prescription drug spending by Medicare. At this time, the most publicized achievement limited the price of insulin products to no more than $35 per month in all Part D plans. In addition, the act will allow the Secretary of the Department of Health and Human Services to negotiate the price of some drugs covered under the Medicare D plans, leading to additional realized savings to plan beneficiaries.

The Inflation Reduction Act will financially impact health plans. More responsibility will be shifted to Part D plans and drug manufacturers for beneficiary coverage in the catastrophic phase. Drug manufacturers will be required to pay a rebate to the federal government if the prices of medications covered under Part D outpace the inflation rate. A cap will also be placed on out-of-pocket drug spending by eliminating the 5% coinsurance requirement of the beneficiary in the catastrophic phase.

Health plans should begin developing strategies to address the potential loss of revenue associated with the Inflation Reduction Act. Resources should be utilized to focus on total patient care and appropriate disease state management with the most cost-effective medications for beneficiaries. The understanding of how well Part D meets the needs of Medicare patients will be highly scrutinized, with these rolling provisions starting as early as the calendar year 2023.

ProspHire is dedicated to helping clients across the country to provide the solutions needed to execute their strategic pharmacy vision. We understand the dynamic nature of the pharmacy landscape and have experience in solving unique healthcare and pharmacy challenges. Contact us here to learn more about how ProspHire can help your organization deliver on its pharmacy strategy.