Social Determinants of Health Screening Tool Implementation Challenges

Social determinants of health (SDOH) are conditions in the environment that affect individuals’ wellbeing, quality of life and health outcomes. They are commonly grouped into domains that include economic stability, education access, healthcare access, living environment and social support. It is important to screen for these determinants in clinical settings because research shows that social determinants of health are linked to negative health outcomes. Standardizing screening tools and providing appropriate community-based resources to patients will help decrease negative health outcomes (Sokol, 2020).

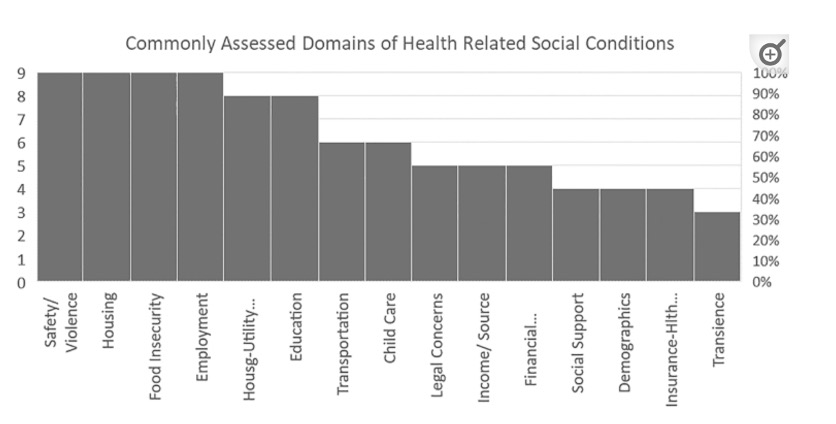

The Institute of Medicine (IOM) recommends that screening tools include common domains such as educational attainment, financial status, social isolation and median income levels as social stability domains (National Academies of Sciences, Engineering, and Medicine, 2016). A review of the literature found that 70% of screening tools measure at least 8 out of the 15 recommended domains and that only 66% of the tools that were reviewed were commonly used in clinical practices (Meon et al., 2020). Although payers and providers recognize social determinants of health as a problem, organizations still struggle to implement and accurately report SDOH data. How can implementation be improved? What makes screening programs successful?

Screening Tools and Barriers to Implementation

There are a wide range of screening tools being used in clinical settings to identify at-risk members. Common screening tools such as Health Leads and PRAPARE are used to assess and address patients’ social determinants of health.

Health Leads screens an individual for adverse social determinants across 13 social needs domains (Health Leads, 2019). The questionnaire is evidence-based and is used in clinical settings. PRAPARE is also a nationally standardized tool used to assess patients’ risks and experiences (PRAPARE, 2022). The standardization of both tools allows them to be easily used by practitioners and integrated into EHR platforms. Despite having standardized tools, without a standardized approach, providers struggle to accurately capture, report and provide appropriate community-based resources for their most vulnerable patients (Fitzhugh et al., 2021; Meon et al., 2020). Standardization is a challenge because tools screen across different domains and lack a common approach to measure duration of time that patients experience social determinants of health. Although these challenges exist, providers have found success by utilizing evidence-based screening tools and developing a community-based approach to provide patients with needed resources (Bleacher et al., 2019).

Health Plans Combatting Social Determinants of Health

University of Pennsylvania Medical Center (UPMC) implemented “Cultivating Health for Success”, a program that partners with community organizations to provide permanent housing to members (Sokol, 2020). The program saw a savings of $6,384 for each of their participating members. UPMC was able to identify their at-risk population and provide them with a permanent solution to better control their social environment and health outcomes. Since the initiation of this program, several other programs at UPMC have been implemented to combat social determinants of health.

The success of the initiatives at UPMC was driven by practitioners recognizing that social determinants of health are interconnected and the importance of screening and identifying at-risk members. By providing members with the necessary community-based resources, UPMC saw significant cost savings because members were better able to manage their health. UPMC also recognized that data collection is paramount to understanding the “full picture” of a member to drive change.

How ProspHire Can Help

The first step to addressing health disparities in your community and across patient or member populations is to understand the underlying drivers of health in your population. That understanding will allow you to execute targeted programming that positively impacts your patients and their health outcomes, driving cost savings related to these disparities. At ProspHire, we have the experience and skillset to help you take that first step. We can partner with your teams to help you implement strategies that drive health equity forward. Connect with us today to learn more.

Resources:

Bleacher, H., Lyon, C., Mims, L., Cebuhar, K., & Begum, A. (2019). The feasibility of screening for social determinants of health: seven lessons learned. Family Practice Management, 26(5), 13-19.

Health Leads Screening Toolkit. Health Leads. (2019). Retrieved April 20, 2022, from https://healthleadsusa.org/resources/the-health-leads-screening-toolkit/

Fitzhugh, C. D., Pearsall, M. S., Tully, K. P., & Stuebe, A. M. (2021). Social Determinants of Health in Maternity Care: A Quality Improvement Project for Food Insecurity Screening and Health Care Provider Referral. Health Equity, 5(1), 606-611.

Meon, M., Storr, C., German, D., Friedmann, E., & Johantgen, M. (2020). A review of tools to screen for social determinants of health in the United States: A practice brief. Population health management, 23(6), 422-429.

Sokol, E. (2020, January 29). How UPMC coordinates compounding social determinants of health. HealthPayerIntelligence. https://healthpayerintelligence.com/news/how-upmc-coordinates-compounding-social-determinants-of-health